|

| Choose Wisely... |

“If I already know someone, why would I use a platform to communicate with them?”

We hear this from time to time – Dealboard members browsing

the thousands of metric tons available any given day on Dealboard, and finding

seafood offered by someone they know. Their temptation is to use their usual

ways of communicating with that party – email or WhatsApp.

Why not?

Here’s why not:

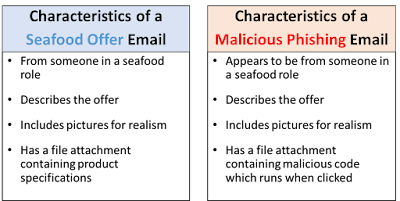

Email isn’t safe

Email is a great way to communicate, but it takes a lot of

work to make it really secure for sensitive communications such as negotiating

large transactions.

And, even with the best security measures in place, things

slip by – have you heard about this recent and high profile example of phishing

in the seafood industry? https://www.farodevigo.es/economia/2023/02/28/estafar-ceo-nueva-pescanova-anunciandole-83867748.html

The CEO in the article is clearly taking it in stride, and

even having a bit of a laugh about the situation. But this is only funny until

someone falls for it, and it’s only funny until it happens to you.

What sizable seafood company hasn't been spoofed in

the past year by an email communication that isn’t really coming from who it is

supposedly from? Things worse than this happen all the time.

Tightening your email security drives up your IT costs

significantly, and doesn’t mean something won’t happen to you. And if you fall

for it, the economic damage to your company could be irreparable.

WhatsApp isn’t much better

WhatsApp is great for instant communication, but you can

never be sure if the person you’re working with is still a representative of

the company you want to deal with.

People change jobs, and when they do they often take their

WhatsApp numbers with them. Suppose they move over to a competitor of yours…

are you really ready to share your prices, inventory and other key information

with your competition?

Then what?

Even if your email or WhatsApp conversations are not

compromised, and you successfully negotiate a transaction, what follows are a

lot of manual steps you need to do to communicate the deal terms to the rest of

your team to follow up with shipping and payment. That means you are re-typing

a lot of information rather than hunting your next deal, or you and your teams

are stuck chasing down misunderstandings with the other party.

What's needed is a safe room, a zone where seafood parties

can get their work done quickly, efficiently, and with reduced risk... so that

they can move on to the next deal and expand their business.

That's why not.